President Donald Trump invoked a wartime and emergency law in March to bolster critical materials and rare-earth metals mining production in the U.S.

"The Defense Production Act (DPA) will be used to expand domestic mineral production capacity," reads the order, referring to the federal law that was established during the Korean War, invoked during the Cold War to help bolster U.S. aluminum and titanium industries, and most recently during the COVID-19 pandemic to increase manufacturing of masks and ventilators.

Now, there could be an effort by Trump to use his emergency powers under the DPA to bolster platinum and palladium mining in Montana and curtail Russian imports of the precious metals.

Montana is the only state where platinum and palladium (the latter used mostly in catalytic converters for cars and trucks) is mined.

Palladium is part of the platinum family of metals. Montana is the only U.S. state where the two metals are mined.

Russian metals imports — which have not been restricted by U.S. sanctions imposed on Moscow after the 2022 invasion of Ukraine — have driven down the price of palladium, according to Sibanye-Stillwater LLC, which operates two mines in Montana.

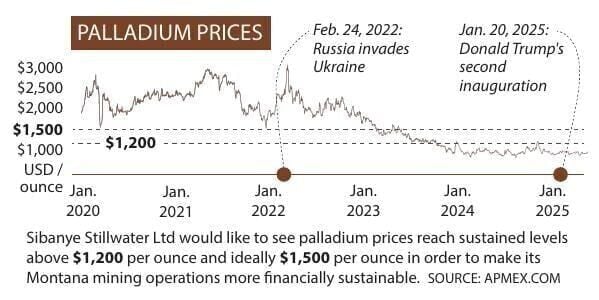

The price of palladium was as high as $3,000 per ounce in March 2022 right after Russia’s invasion of Ukraine.

The price has dropped more than 68% since then with palladium prices trading at or below $1,000 per ounce, according to APMEX.com. Palladium closed at $944.50 per ounce on Monday, May 12.

South Africa-based Sibanye-Stillwater cut 640 jobs at its Montana mines last year, citing lower palladium prices. There are still more than 1,000 workers at the Montana mines. Palladium is part of the platinum family of metals. It is also used in jewelry, coinage, dentistry and electronics.

Heather McDowell, vice president of legal and external affairs for Sibanye Stillwater, said palladium prices need to reach sustained levels of at least $1,200 and ideally $1,500 per ounce to make Montana mining operations financially viable and sustainable.

“To get over $1,200, to get to $1,500, that would be a very good thing for us,” she said.

Those price levels would have to be sustained at least for a couple of months for the mining group to ramp up its Montana operations again, McDowell said.

The group is also trying to get its own costs down to $1,000 per ounce at its Montana mines.

“That’s our stated goal,” she said.

For the most recent quarter ending March 31, Sibanye-Stillwater reported costs at its U.S. mines in Montana were $1,284 per ounce down from $1,560 per ounce at the end of 2024 and $1,335 for the same quarter a year ago.

The mining firm and Montana’s four GOP lawmakers are also pushing for restrictions from Congress and/or Trump on Russian precious metals imports — including platinum and palladium.

Russia accounts for between 40% and 45% of the world’s palladium. Last year, it was 39.5%.

South Africa mined 37.9% and the U.S. 4% of palladium, according to the U.S. Geological Survey.

Montana U.S. Sens. Steve Daines and Tim Sheehy and U.S. Reps. Troy Downing and Ryan Zinke (all Republicans) have introduced a bill in Congress to ban Russian imports of platinum, copper, zinc, nickel, palladium, braggite, ruthenium and rhodium.

China is also a top producer of many rare earths and precious metals.

The GOP quartet also wrote to Trump on April 29 asking for him to take “actions” to address palladium imports from Moscow.

A $25 palladium U.S. coin issued in 2017.

“To strengthen our domestic supply chain, protect our national security, support American markets, and put our mining and processing workers back to work, we respectfully urge you to address unfair Russian trade practices and illegal dumping by taking any necessary and appropriate actions,” the Montana lawmakers, who have all been endorsed by Trump, said.

Trump has not included Russia in his expansive tariffs regime since taking office, arguing that it excluded Moscow in the midst of negotiations to end the war in Ukraine.

Trump did impose a 10% tariff on Ukraine in "Liberation Day” levies. But he has more recently talked about additional U.S. sanctions. Trump has issued other emergency and wartime powers to impose tariffs as well as to deport alleged Venezuelan gang members.

Trump issued an executive order in March invoking the DPA for potential critical minerals production, including streamlining approval processes for mining on public lands. Last month, Trump also ordered a federal inquiry into the national security ramifications related to the reliance on imports of critical resources and rare-earth elements used in technology equipment, vehicles and other essential items.

The federally designated critical minerals list includes palladium, platinum, lithium, arsenic, cobalt and 45 other metals and elements.

McDowell said supply chain needs are part of the law, which was first used during the Korean War and also invoked during the COVID-19 pandemic by Trump and former President Joe Biden for medical equipment and supplies.

“We think the market is still greatly affected by Russian dumping into the U.S.,” McDowell said.

She said while other critical resources projects are in the planning phases and years away from reality, the Montana mines are operational.

“We really think it’s a very, very good fit,” she said of potential federal financial help for palladium mining as well as restrictions via the DPA on Russian imports.

Montana GOP lawmakers would like to see President Donald Trump take some actions to boost domestic palladium and platinum mining and curtail Russian imports of the precious metals.

Downing welcomed efforts to “incentivize domestic palladium production” along with the Montana lawmakers’ legislation restricting Russian metals imports as long as the war persists.

“Decreasing American reliance on foreign inputs has never been more important to decouple our supply chains from foreign adversaries and strengthen U.S. national security,” said Downing, whose eastern Montana district includes the two palladium mines.

“My Stop Russian Market Manipulation Act takes a big step in the right direction by banning imports of Russian critical minerals like palladium. I welcome efforts to incentivize domestic palladium production that augment this legislation and extend a lifeline to the Stillwater mine in my district.”

Still, future demand for palladium has been complicated by the global growth for electric cars, which don't utilize catalytic converters.

“Most of the demand for platinum and palladium comes from catalytic converts in internal combustion vehicles. Many have been bearish on these metals because of the fear that growing electric vehicle demand will reduce demand for these metals,” said John Berman, chief investment officer for Berman Capital Group LLC, a Philadelphia-based investment firm.

“So while the demand for these metals decades from now might be substantially less due to electrification, it seems pretty clear to me that internal combustion engines are not disappearing anytime soon,” he said.