Oil and Gas Accumulators Market to Reach USD 4241.9 Million by 2031 Driven by Surging Demand for Crude Oil

Fueling Efficiency: Trends and Growth in the Oil and Gas Accumulators Market

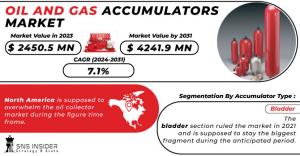

TEXES, AUSTIN, UNITED STATES, June 17, 2024 /EINPresswire.com/ -- The Oil and Gas Accumulators Market size was valued at USD 2450.5 Million in 2023 and is expected to reach USD 4241.9 Million by 2031, growing at a CAGR of 7.1% over the forecast period 2024-2031.Download Sample Copy of Report: https://www.snsinsider.com/sample-request/2411

Some of Major Key Players:

Accumulators Inc.

Airmo Inc.

Bosch Rexroth AG

Eaton Corporation PLC (Eaton)

HAWE Hydraulik SE

Hydac Verwaltung GmbH (Hydac)

Hydroll

Nippon Accumulator Co., Ltd,

NOK Corporation

Parker Hannifin Corp.

Rising safety concerns and the need for efficient operations in oil and gas exploration propel the Oil and Gas Accumulators Market.

The Oil and Gas Accumulators Market is experiencing significant growth due to the ever-increasing demand for crude oil globally. This necessitates a rise in drilling and exploration activities, making oil and gas accumulators a crucial companion for market expansion. As onshore oil reserves dwindle, companies are venturing into deeper and more challenging exploration projects, further amplifying the demand for these accumulators. Oil and gas accumulators play a vital role in mitigating environmental and safety risks at oil and gas exploration sites. They are extensively used for various applications, including leakage compensation, managing unpredictable pressure surges, and noise reduction. The ever-growing demand for crude oil globally translates to increased drilling and exploration activities, which in turn, fuels the demand for oil and gas accumulators. Moreover, with depleting onshore oil reserves, companies are actively pursuing deeper offshore exploration projects, further propelling the need for these advanced technologies.

In the oil and gas industry, accumulators function as hydraulic energy storage devices, providing a reliable and rapid power source for well control, emergency shutdowns, and other critical operations. This significantly enhances the safety and overall performance of oil and gas production, processing, and exploration activities. To mitigate potential risks and emergencies, hydraulic accumulators are frequently employed in blowout preventers, wellhead control systems, and other high-pressure applications.

Segment Analysis

By Accumulator Type, Bladder accumulators currently dominate the market owing to their simple design, low maintenance requirements, and cost-effectiveness. However, piston accumulators are anticipated to gain significant traction in the coming years due to their ability to handle higher pressures and offer greater efficiency.

By Application Type, The well control segment holds the largest market share due to the critical role accumulators play in ensuring wellbore integrity and preventing blowouts. The surge in deepwater exploration activities is expected to further bolster the demand for accumulators in this segment.

Impact of Russia-Ukraine War and Economic Slowdown

The ongoing Russia-Ukraine war has disrupted global supply chains and caused significant fluctuations in oil and gas prices. This has led to short-term volatility in the oil and gas accumulator market. However, the long-term outlook remains positive as the demand for oil and gas is expected to remain robust in the foreseeable future.

An economic slowdown can potentially dampen the demand for oil and gas, thereby impacting the oil and gas accumulator market. For instance, a significant economic downturn could lead to a decrease in drilling activity, which would translate to lower demand for accumulators. However, the essential role these accumulators play in ensuring safety and efficiency is likely to mitigate the impact of economic slowdowns to some extent.

Buy Complete Report: https://www.snsinsider.com/checkout/2411

Key Regional Developments

The Asia-Pacific region is projected to witness the fastest growth in the oil and gas accumulator market due to the increasing demand for oil supplies in countries like China, and India. This growth is further amplified by the presence of major state-owned oil and gas companies in China with extensive exploration and production operations.

Recent Developments

In April 2023, Temprite, introduced a new transcritical CO2 coalescent oil separator designed to address the growing demand for larger CO2 systems. This development highlights the potential for accumulator applications beyond the traditional oil and gas industry.

In May 2020, The H2REF project successfully demonstrated the use of hydro-pneumatic accumulators for refueling hydrogen fuel cell vehicles. This showcases the versatility of accumulator technology and its potential for facilitating the transition to clean energy sources.

Key Takeaways

The rising demand for crude oil and the shift towards deep-sea exploration are key drivers of market growth.

Focus on safety and efficiency in oil and gas operations is propelling the adoption of advanced accumulator technologies.

The Asia Pacific region presents lucrative growth opportunities due to increasing oil demand and state-driven exploration activities.

Technological advancements and a focus on sustainability will shape the future of the oil and gas accumulator market.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.